Loan defaults in the Debt service

The Debt service of WebMoney - is an automatic service for management of debt relations between the members of WebMoney Transfer.

After adding a new contact to your list, you may set theTrust Limit, i.e. allow your contact using funds from the selected purse in assigned amount and under assigned conditions.

If the borrower failed to return the loan by the due date, the lender may take the following actions:

-

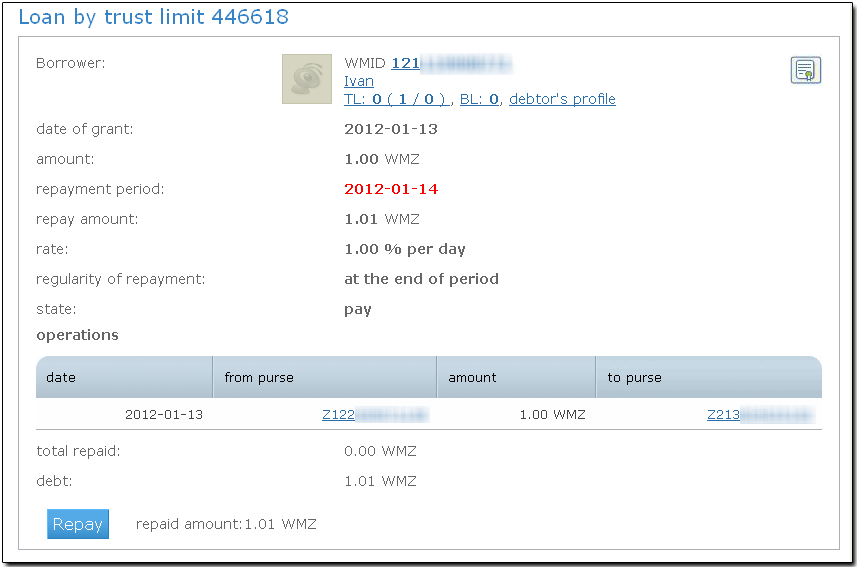

Perform forced debt repayment using means of Debt service. The terms of service provide the opportunity to repay the loan in a forced order or withdraw funds from the purses of the borrower to the lender, or due to open limits of other contacts of the Borrower.

ExpandAt the website of the Debt Service:

- go to the tab 'I Trust' - "Loans";

- select delinquent loan;

- press "Return" button.

If there are funds on the purses of the Borrower, the loan will be repaid. If the purses do not have enough money to repay, the system will involve other trust limits, open to the debtor by other system members.

In this case, the Borrower acknowledges these transactions as committed on their behalf and certified by an analogue of a handwritten signature.

-

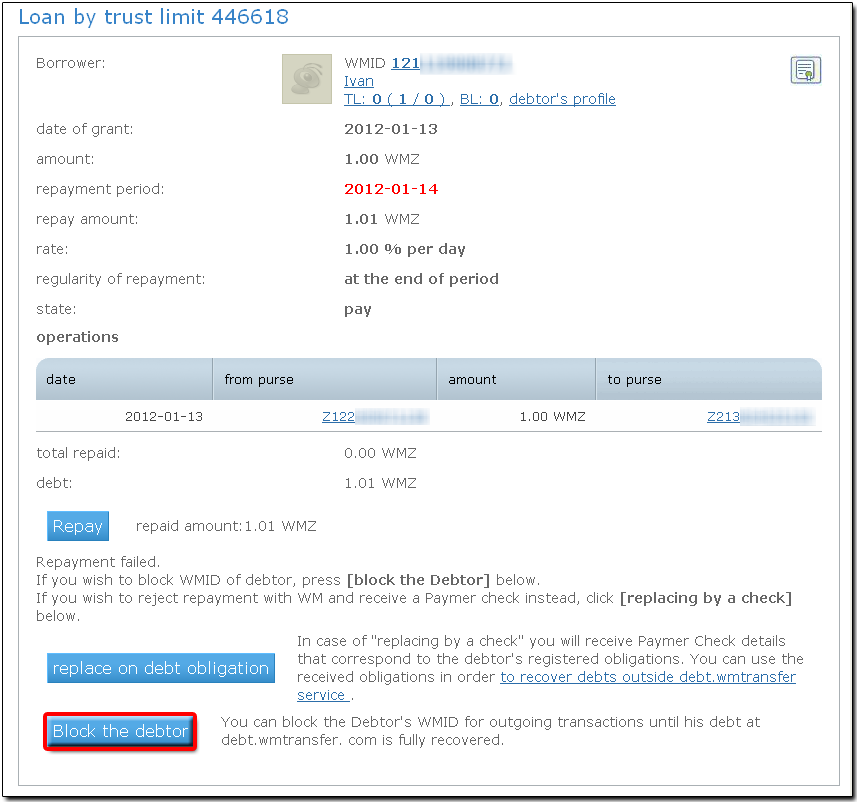

Block borrower until full repayment of the debt. In the event of failure to return the loan and if the debtor has no assets and other trust limits, the lender may block the borrower until full repayment of the debt and enter into negotiations with him/her on the return of the debt on the loan.

ExpandAt the website of the Debt Service:

- go to the tab 'I Trust' - "Loans";

- select delinquent loan;

- press "Return" button.

We will attempt to return the loan. And if the return failed, you will see the enabled button "Block the debtor". After blocking, any debit transactions from purses of the borrower will be not available, except for operations on returning the loan.

-

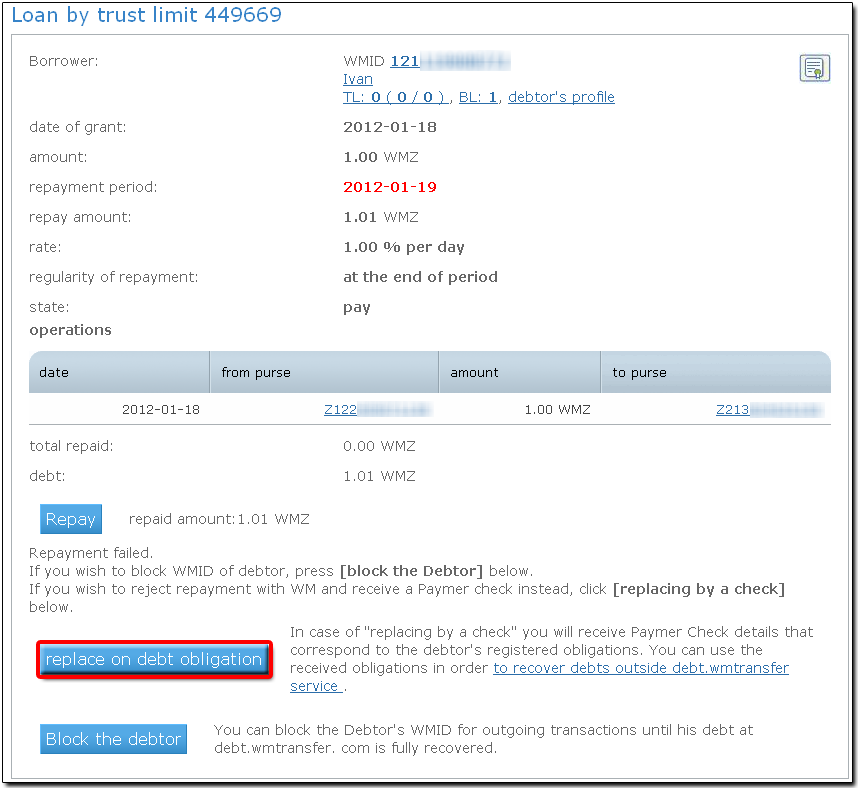

Convert to a loan to a promissory note of Paymer format - for recovery of the debt out of the System or to sell the promissory note on the Exchange of debts, or for debt collection outside the system.

ExpandAt the website of the Debt Service:

- go to the tab 'I Trust' - "Loans";

- select delinquent loan;

- click "Return" button;

- click "Replace with a debt obligation";

-

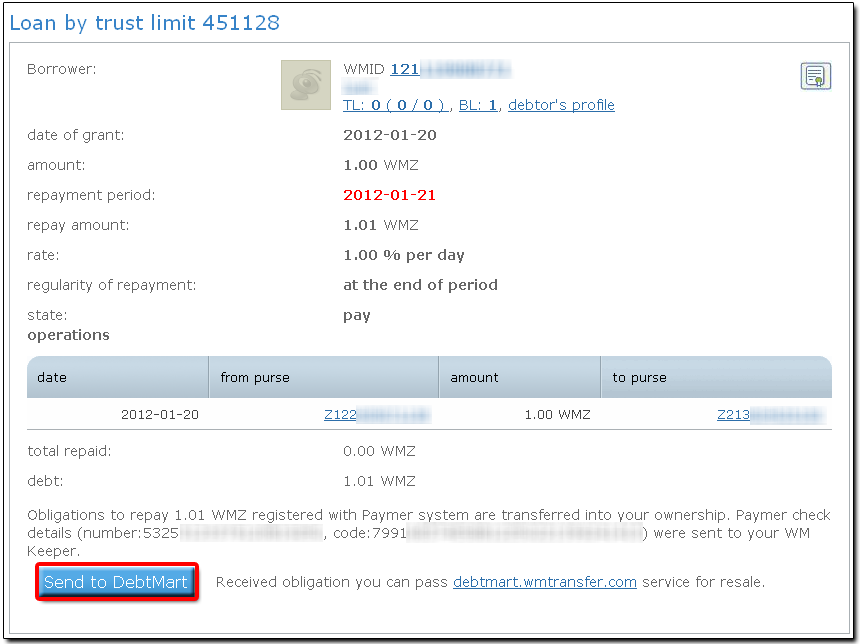

Sell a debt obligation (Paymer) Obligations Exchange. If the lender in any way fails to return the overdue loan, he/she can get registered in the Paymer system borrower's obligation to repay the remaining funds and transfer it to the Exchange for the debt to sell.

ExpandAt the website of the Debt Service:

- Go to the tab "I trust" - "Loans";

- select delinquent loan;

- click "Return" button;

- click ”Send to DebtMart” button;

-

Get documents under the obligation to debt recovery through the court. If you fail to agree with the debtor to replenish the obligations, the owner of the bill can appeal to the courts.

ExpandTo start proceedings on a debt obligation, the Exchange provides an opportunity to obtain the following documents:

- The obligation of the issuer - it is a document signed by the borrower in obtaining funds through the Debt service.

- Commitment to the presented bill - it is a document showing how much of the general obligations of the debtor belong to the owner of the obligation. It is signed by WMID of Paymer service.

- Electronic copies of the passports of the borrower and his/her application for a passport. (If these documents are available at the Verification centre).

Please note: The operation of obtaining the documents can not be undone. After it is implemented, obligation on the Exchange stops, and you cannot register and sell it again.

The procedure for obtaining documents for the obligations of the Exchange will be discussed in detail in in the instructions.